Capital

-

Visit Website Website

Website -

[email protected], [email protected] Skype

Skype -

+357 25 262045 FAX

FAX -

[email protected], [email protected] Email

Email -

+357 25 262045 Telephone

Telephone

Trading Info

Accounting Info

Contact Info

Broker Info

Capital.com (general info)

Individual Group Entities Authorised and Regulated By: the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, the Financial Services Authority of Seychelles (FSA), the Australian Securities and Investments Commission (ASIC).

Group Headquarter: 28 Oktovriou, 237 Lophitis business centre II, 6th floor, Limassol, Cyprus, 3035

Foundation Year: 2016

FAX +357 25 262045

Email - [email protected], [email protected]

Telephone +357 25 262045

TRADING INFO

Min. Deposit - $20 (by card)

Max Retail Client Leverage - FCA - 1:30, CySEC/ASIC - 1:30

Min. Spreads - The minimum spread is 0.1 pips in normal market conditions

Mobile Trading - Yes

Web Trading - Yes

Trade Platform - Mobile Apps, Web Platform, MetaTrader 4 (for CYSEC/ASIC), TradingView

Accounting Info

Swap Free Acc - Yes (not under CYSEC/FCA/ASIC)

Acc Funding Methods - Wire Transfer, Credit Card, Debit Card, Skrill, Neteller (not under CySEC), UnionPay, Apple Pay, WorldPay, RBS, Trustly, GiroPay, iDeal, Multibanco, Przelewy24, Sofort, Qiwi, WebMoney, Asian online banking, Poli payments

VIP Accounts - Yes

Mini Accounts - No

Segregated Acc - Yes

Free Demo Acc - Yes

CONTACT INFO

Broker Name: Capital.com

Country: Cyprus

Base Currencies: GBP, USD, EUR, PLN, and AUD.

Languages: English, Spanish, German, French, Arabic, Russian, Romanian, Polish, Italian, Farsi, Vietnamese, Turkish

News Trading: Yes

Capital.com - FEATURED BROKER PROFILE

Website: https://capital.com/

Year Established : 2016

Group Headquarter: 28 Oktovriou, 237 Lophitis business centre II, 6th floor, Limassol, Cyprus, 3035

Regulation: authorised and regulated by the Cyprus Securities and Exchange Commission with CIF licence number 185/12, the Financial Services Authority of Seychelles (FSA), the Financial Conduct Authority of the UK with number 793714, and the Australian Securities and Investments Commission (ASIC).

International offices - Lithuania, Poland, United Kingdom, Ukraine, Cyprus, Gibraltar, Bulgaria, Seychelles, Australia

Live Chat - yes

Phone - +357 25 262045

Fax - +357 25 262045

Email - [email protected]

Website Languages - English, Spanish, German, French, Arabic, Russian, Romanian, Polish, Italian, Farsi, Vietnamese, Turkish

ACCOUNT INFORMATION

Free Demo Account - yes

Min. Deposit - $20 if the funds are transferred via credit/debit card, Apple Pay, or PayPal. For bank transfers, the minimum deposit is $250.

ECN account - no

Account Currencies - GBP, USD, EUR, PLN, and AUD.

Maximum Leverage - up to 1:30 retail clients

Segregated accounts - yes

Swap-free Accounts - yes (not under CYSEC/FCA/ASIC)

MAM/PAMM accounts - no

Managed account - no

Interest on margin - no

Deposit/ Withdraw Options - Wire Transfer, Credit Card, Debit Card, Skrill, Neteller (not under CySEC), UnionPay, Apple Pay, WorldPay, RBS, Trustly, GiroPay, iDeal, Multibanco, Przelewy24, Sofort, Qiwi, WebMoney, Asian online banking, Poli payments. Deposits and withdrawals are free at Capital.com.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

TRADING TERMS

Trading Platforms - MetaTrader 4 (for CYSEC/ASIC), Proprietary platform, Web-based, TradingView, Mobile Apps

Type of Spread Commission - spread

Lowest spread on EURUSD - from 0.6 pips on EURUSD in normal market conditions

Scalping - allowed (on CFD and Spread Betting offerings)

Hedging - allowed

Expert Advisors - some expert advisors are allowed on MT4 offering

One-click execution - yes

OCO orders - no

Mobile Trading - yes

Web Trading - yes

Gold, Silver CFDs - yes

Other Trading Instruments - yes

Promotion - Give a share-get a share

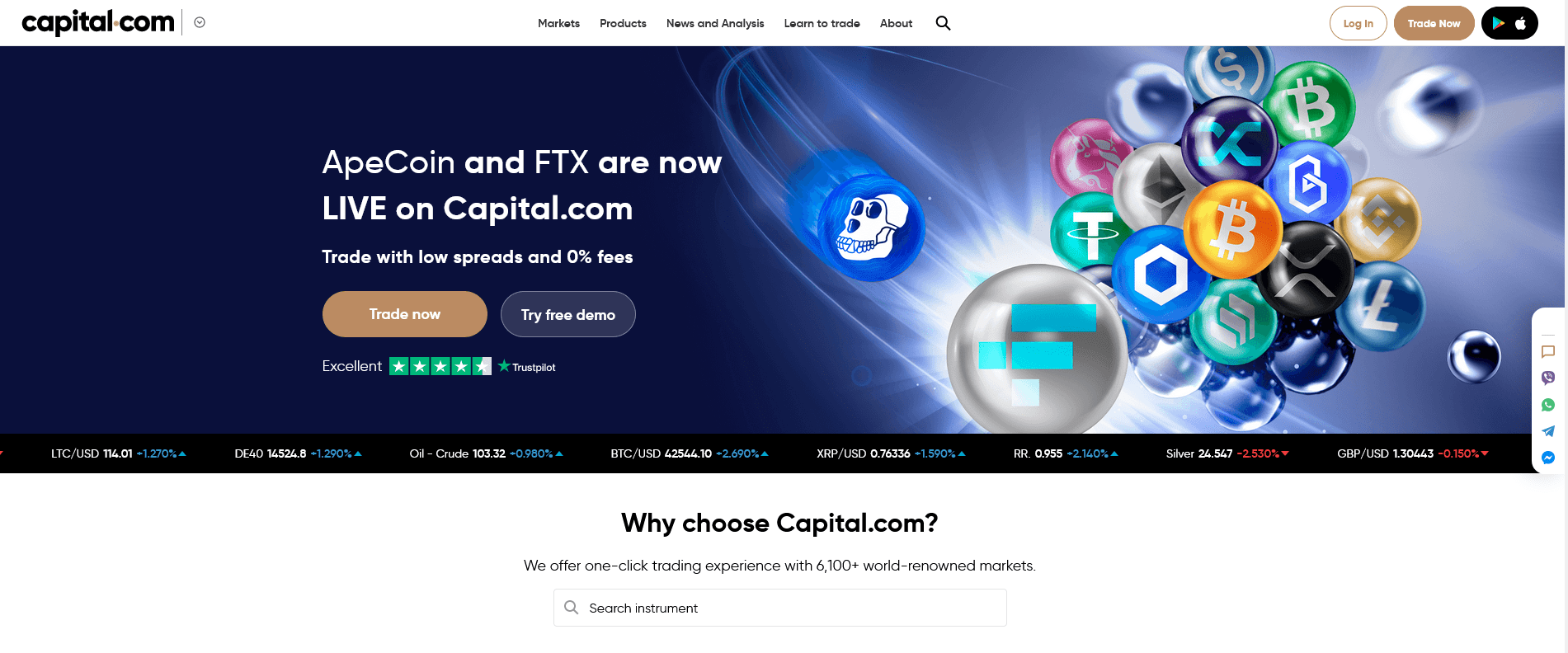

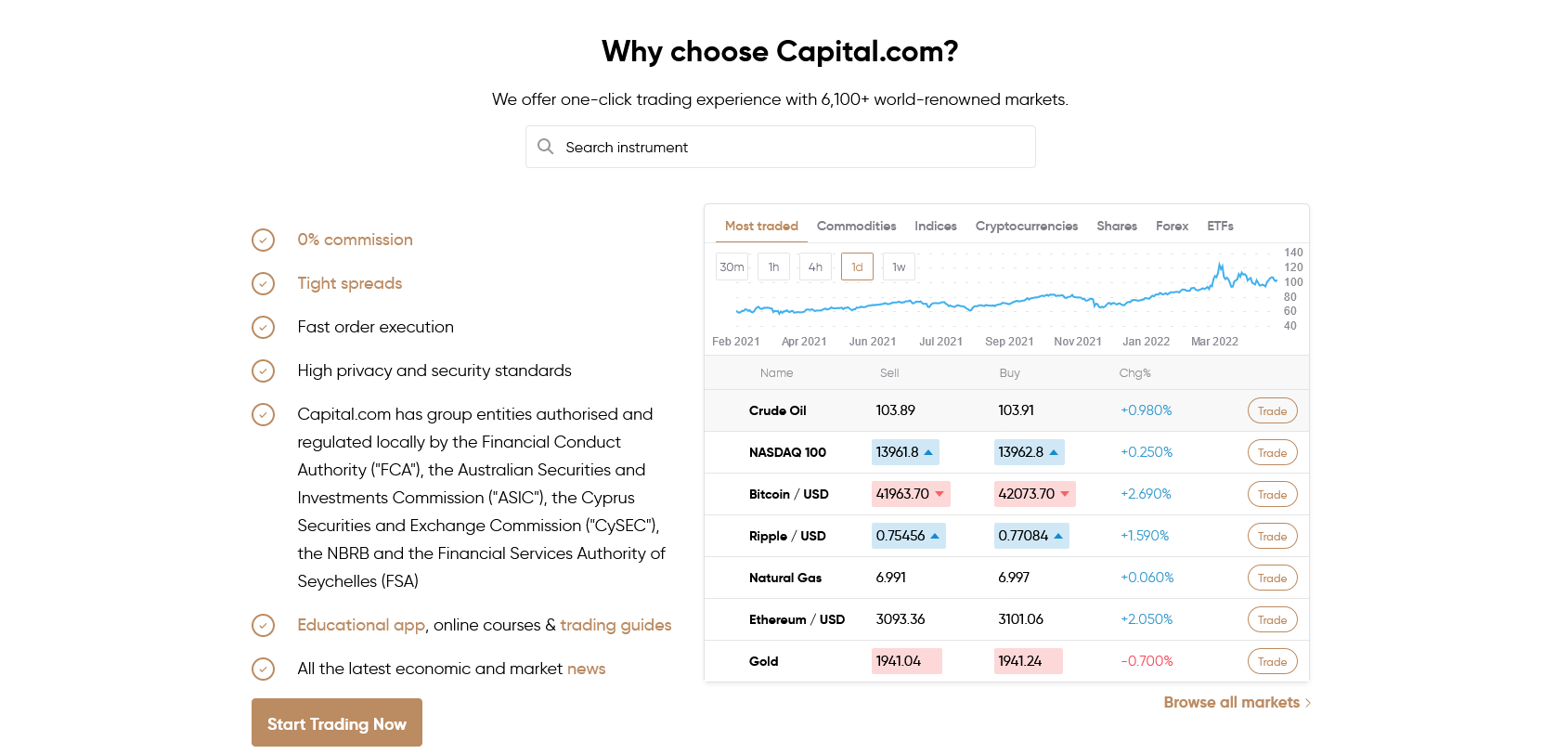

Why choose Capital.com?

Capital.com is a high-growth investment trading platform empowering people to participate in financial markets. Its intuitive, award-winning platform, available on web and app, offers investors a seamless trading experience to over 6,100+ world-renowned markets. To help investors trade with confidence, the platform is enabled with robust risk management controls and transparent pricing while its all-in-one Investmate app delivers extensive financial lessons and educational content to support clients in their investment journey.

Capital.com has clients in over 180 countries with offices located in the UK, Gibraltar, Australia, and Cyprus. In 2021, the platform reported a 350 per cent growth in its client base, making it one of Europe’s fastest growing investment trading platforms with more than 4 million registered users.

Benefits of Capital.com

Fast order execution

High privacy and security standards

Large range of products

Modern, easy-to-use interface

Free demo account for all new users

Quick registration

Trade CFDs on the world’s biggest markets

Capital.com offers leveraged trading with 0% commission

and tight spreadson the following markets:

Indices (US100, DE40, US30 etc)

Forex (EUR/USD, GBP/USD etc)

Commodities (Oil, Gold, Natural Gas)

Shares (Amazon, Tesla, Netflix etc)

Cryptocurrencies (Bitcoin, Ethereum etc) - Cryptocurrency derivatives are not available to UK retail clients

Offering of investments

Capital.com offers real stock trading with 1,000+ shares available, and CFD trading with 6,000+ markets to choose from, including 5,000+ shares, 23 indices, 138 forex pairs, 476 cryptos*, 41 commodities, and nearly a dozen thematic indices. Note that spread betting is also available to UK residents.

Trading with Capital.com is commission-free and the spreads are competitive. Deposits and Withdrawals are also fee-free and there are a variety of funding options available including via debit/credit card, bank wire, PayPal, Trustly, iDeal, Giropay, WebMoney and more. Furthermore, the broker offers multilingual customer support 24/7 via phone, email and live chat.

There is a variety of market research and educational material available including news, market analysis, webinars, Capital.com TV, an economic calendar, trading courses, trading guides, a glossary and an educational trading app called Investmate.

Capital.com is recommended for traders who want to leverage the power of technology. It is also recommended for investors who are looking for a premium user experience. The broker offers a mobile app that leverages Artificial Intelligence (AI) in order to improve the trading experience by providing traders with a comprehensive post-trade behavioural analysis. It is one of the few brokers that makes use of this technology to help its traders understand their cognitive biases.

How to open your account

The account opening experience at Capital.com is excellent: it is smooth, quick and easy.

Here are the steps to open an account at Capital.com:

Create an account and you will have immediate access to the live platform. This allows you to become familiar with the platform before trading.

Within the platform, click 'Complete registration'.

Go through a list of questions about your basic data (country of residence, employment status, financial status, appropriateness). The clean design makes the process smooth and enjoyable.

Select your account currency.

Finally, if requested to do so, upload your personal ID (passport, driver's licen�e, or national ID card) and proof of residence (bank statement, utility bill, etc).

Give a share, get a share

Capital.com gives you the opportunity to get free stock of up to €250 a year with its popular Stock-Referral promotion. Simply invite one, two or multiple friends to join Capital.com. All they need to do is verify their accounts and make a trade-then you each get a free share.

An award-winning member of the leveraged trading industry

Capital.com was founded in 2016 with the aim to create a safe and trusted environment for investors. Our vision is that everyone can be a trader with the right support and right access to technology and education. We provide both, being on a mission to change the face of traditional investing.

Spreadbets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Reviews (1)

Add Your review

with lowest cost

PRO Trader Tools

Signals

Bonus New

with CopyTrader

great opost

Monday 11th of March 2024 06:09 AM

such a great work. padel game